October 2022 Newsletter

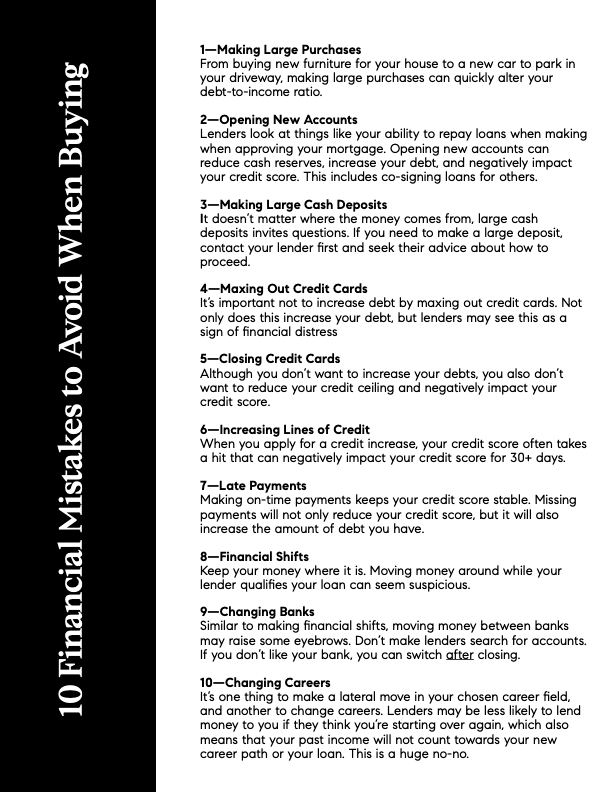

There’s nothing I love more than helping people buy the home of their dreams. But, sometimes, people unknowingly make financial mistakes that can disqualify them from buying or otherwise cause a lot of frustration and headaches.

If you’re thinking about buying a home, remember this first and foremost: Now is NOT the time to make big financial moves. What's considered a big financial move? More than you may realize:

These are some of the most common mistakes home buyers make when purchasing a home. And while making a mistake doesn't necessarily mean you won't be approved for your loan, it is nevertheless important to know the risks before beginning the home-buying process.

This is where my team and I come in!

It is impossible for buyers to know all of the complexities involved with securing loan approval. We will not only connect you with one of our trusted lenders, but we will also educate you about the home buying process and potential road blocks to avoid so you don't unknowingly make a mistake that can cost you your dream home. We do this because we want the home-buying process to be a positive, successful one for you. We do this because we care about every client experience as if it were our own.

So if you're thinking about buying a home, please connect with me before making any financial moves. I am here to help and serve you.

Facts & Figures You Need to Know!

70% of Realtors have never worked in a normal market

80% of lenders have never worked in a non-refi market

Have you or anyone you know been wondering if now is the right time to buy?

So far this year, home sales have been the 2nd highest since 2007, behind only 2021 - when inventory was low, demand and prices were extreme, rents began to skyrocket, and market conditions favored sellers.

But recent increases in interest rates have slowed the market slightly, turning favor towards buyers instead. Let's look at some of the data from September based on National statistics:

Pending home sales decreased 19.1% year over year, and bidding wars have decreased as well.

The average home sold for .3% below list price, whereas in 2021 it sold for 1.2% above list price.

Only 35% of homes sold above asking price, down from 49% the year prior.

In August, asking rental prices increased nationally by a record 11%. Los Angeles experienced a 6.1% increase, with median asking rents reaching $3,547.

Many buyers are uncertain about purchasing right now in the wake of rising interest rates, but now can still be a great time to purchase so that you lock in your mortgage rate before it goes any higher. And with rental prices skyrocketing right now, a mortgage payment may end up costing you less than what you'd spend each month on rent.

P.S. Remember to marry the house and date the rate!

Are you a practicing physician, OR do you know one?

We have exclusive lender programs with flexible terms tailored to the needs of new and practicing doctors:

• Low down payments

• Special consideration for student loan debts

• Gift funds

• Special loan payment options

• Flexibility to close up to 90 days before your position starts

Lisa Kirshner Properties is the only DRS-designated realtor in the Greater Los Angeles area with exclusive rights to help any M.D., D.D.S., or D.O. take advantage of insanely exclusive mortgage and refi programs with flexible terms in Los Angeles. The best part? It doesn't matter how seasoned and established they are in their medical career! Our exclusive programs help medical school graduates, doctors in residency, and practicing doctors alike achieve their real estate needs.

Want to know more?

Click the button below!